Meat the Future: Plant-Meat Hybrids and 3D Steaks

“Sizzling and juicy, with a crisp layer of fat along the edge.” (Bobby Flay)

“…Thick and succulent, with a crunchy crust and a tender center.” (Food Truck Empire)

“I was expecting the texture to be a little more soft and there is quite some flavor with the browning…but the consistency is perfect,” Hanni Ruetzler, on tasting the first lab-grown burger in 2013.

When you bite into a steak, hamburger, chicken thigh, or any piece of meat, there are so many sensations happening as your teeth make their way through that piece of flesh. Your brain is registering:

Tender. Delicate. Chewy. Flakey. Grainy. Dense. Hard.

And unless that feeling is something weird (sandy), something unpleasant (gooey), something you’re not expecting (slimy), you probably take texture for granted.

Companies producing alternate protein or cultivated meat products face the challenge of accurately replicating the texture of “natural” meat.

What is Meat?

The dictionary definition tells us meat is “animal flesh that is eaten as food.”

Scientifically, meat is made up of muscle cells, connective tissue, and fat. Muscle is approximately 75% water, 20% protein, and 5% a combination of fat, carbohydrates, and minerals.

But the definition and that list of ingredients hide the complexity of animal flesh.

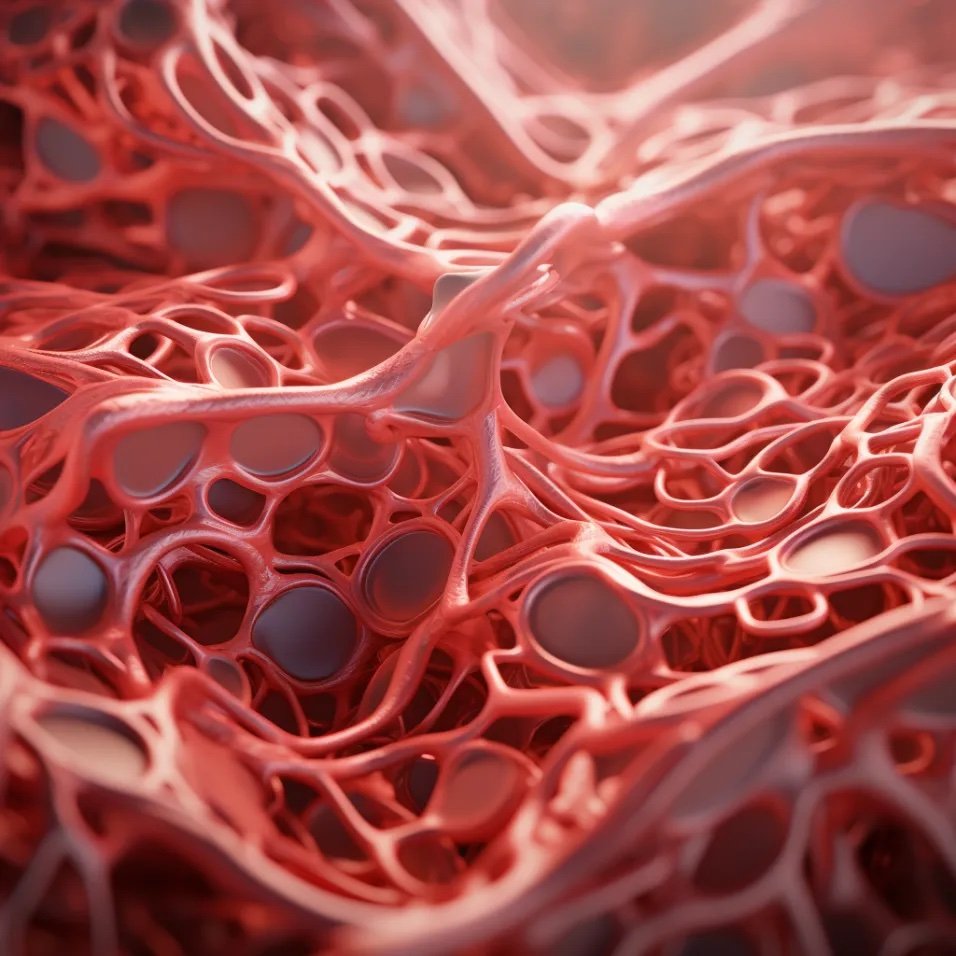

In vivo cells exist in a complex matrix of proteins and proteoglycans (that is, proteins onto which sugar molecules have been attached). That matrix is called the extracellular matrix (ECM). During post-mortem aging of an animal, the ECM disintegrates and contributes to the tenderness of meat texture.

The Good Food Institute’s Deep Dive: Cultivated Meat Scaffold presents a heavily referenced guide to structures under research and development for the cells to mature into muscle and fat, while allowing nutrients and oxygen to reach those cells.

To say the structure and texture of meat are complicated is a huge understatement. That complexity, and the ability to mimic it during the production of cultivated meat, while doing so at prices competitive with traditional sources of animal meat, will determine how quickly cultivated meat gains wide acceptance.

As of this writing (November 2023), many cultured meats in development are in the form of unstructured cells. The animal cells are grown in bioreactors, harvested, centrifuged, then go through a process that will eventually turn them into, for example, chicken nuggets[2], a form factor that doesn’t require too complex a texture.

Ground Meat and Hybrid Products

Today, about 40 percent of beef purchased in the supermarket is ground. Prolly because it’s easy to use and make:

You take what’s leftover from an animal that you can’t sell as a cut, mix it with fat, and grind it.

Because so much meat is in the form of ground or processed meat products, it is attractive for cultured meat companies to grow their cells (plant, fungi, or animal) and use them as additives to ground meat products.

Hybrid products that include a mix of proteins from plants (soy), fungi (mushrooms) and animals (fat and muscles) can be designed to be rich in protein and dietary fiber, a valuable addition to any diet that isn’t found in traditional meats. Products that use alternate plant proteins could contain less meat, fat and cholesterol than conventional products.

Hybrid products could be adopted by meat eaters not ready to give up their favorite dishes but are looking for ways to eat healthier and reduce their carbon footprint.

They also give alternate protein companies access to existing markets and products.

Several small-scale and large-scale companies offer a variety of hybrids. They include Phil’s Finest, Rebel Meat, Hidden Veggies, Perdue, Tyson, Hormel, Dairy Farmers of America.

Examples of hybrid products include Momentum Foods Paul’s Table, which blends plant-based meat with animal components (link); Wilk’s plant-based + cultivated milk fat yogurt (link); Mycorena’s blended fungi and meat products (link).

In April, Food Navigator surveyed attendees at their Positive Nutrition Summit and found an overwhelming majority (85%) of attendees believed the hybrid category has a future.

The market tells a different story.

According to an April 2023 Food Navigator story, many of the meat and plant-based offerings launched in the past few years have come and gone. Tyson Foods, for example, discontinued its Raised & Rooted line of hybrid products. BrewDog’s 2020 hybrid burger is no longer on the menu.

There are many challenges in marketing these products: Are they meat? Or are they alternate proteins? What are they?

Surveys show that consumers still perceive meat products as tastier compared to hybrid products.

But European consumers, when given a choice, expressed willingness to try hybrids containing 25–50% plant substitutes.

We believe there is a market for these products. They offer both alternate protein and cultivated meat producers a way to reach the market with products at a cost that is attractive to consumers. They also offer alternate protein and cultivated meat companies the opportunity to work with a texture that consumers are already familiar with, and may even offer a better texture experience for now. In addition, any food products that help reduce our dependence on livestock agriculture are welcome.

But the narrative around the product had better be great.

Printed Meat is Beautiful, But Will It Scale?

Imagine a steak.

About an inch thick. Deep red in color, interspersed with white lines of fat. The exterior surface looks moist, while the interior will appear slightly glossy. It will feel firm yet yielding to the touch. Place it on a hot enough pan or grill and the steak will begin to sizzle.

If you’re a meat eater, you might find great appeal in a photograph of a steak. Which is why I think the press loves writing stories about the companies that are using 3-D printers to produce meat. The images are stunning. They look like animal-derived steak. Here’s what you’ll see on the websites of:

These companies are pioneering the printing of meat from lab-grown stem cells using an additive manufacturing process: Muscle and fat cells are extruded from a printer nozzle and layer-by-layer a piece of printed meat is constructed.

According to those who’ve tasted them, these protein-packed meat prints replicate the look and mouthfeel of conventionally farmed, butchered meat. In other words, they get the texture of meat “right.”

Novameat was the first company in the world to 3D print a meat-free beef steak in 2018. The Barcelona-based production group benefited from the founder and CEO Giuseppe Scionti’s decade of tissue engineering experience and expertise with lab-grown meat.

Since the introduction of the first 3D-printed steak, the world has looked to 3D printing as a viable substitute for meat products, satisfying meat lovers, and - when using plant-based ingredients - satisfying vegetarians and vegans. 3D-printed meat is attractive to environmentally conscious consumers because it eliminates the animal.

The Pros and Cons 3D Printed Meat

The companies producing 3D-printed meats still need to grow and feed the cells that they push through their printers, and growing those cells is challenging: It requires the right cells, the right culture media (the stuff that feeds the cells), and the right downstream processing (the purifying of the cells after they’ve been grown) to make sure the meat not only looks good but tastes great. Plus you need large facilities to produce that printed meat at scale if you’re going to make a dent in livestock agriculture.

Among the companies pioneering 3D meat printing are Novameat, Redefine Meat, Believer Meats, Aleph Farms, Mosa Meat, Stakeholder Foods, Shiok Meats, VGN Boulevard, and Meatable.

Investments in plant-based proteins, as reported in a 2022 study by Boston Consulting and Blue Horizon, demonstrate significant decarbonization impact, avoiding more greenhouse gas emissions than investments in sectors like sustainable cement or energy. This highlights the broader environmental potential of alternative protein sources, including hybrid meat products and 3D-printed meats. With increasing global investments in sustainable foods and advancements in technology, the alternate protein market share could rise significantly by 2035, potentially reducing CO2 emissions by 2.2 gigatons.

While we appreciate the potential of 3D-printed meats, scaling presents significant challenges. Investment in 3D-printed meats is not just about backing a novel food technology: It's about participating in a transformative shift towards more sustainable, efficient food systems.

This sector has seen substantial interest from governments (but not nearly enough) and private investors alike, recognizing its role in mitigating climate change and revolutionizing food production.

For investors, this means considering the entire ecosystem of 3D-printed meats. That ecosystem includes supporting companies developing proprietary cell lines and the real estate and facilities for large-scale production. It also means supporting those companies focused on building consumer-friendly brands - because branding and marketing are keys to success.

Investing in 3D-printed meats - like any alternative protein investments - is about investing in a future where technology, sustainability, and food innovation converge.

That said, investors should be mindful of the challenges, including scaling production, navigating regulatory landscapes, and achieving consumer acceptance. It's a balancing act between technological feasibility and market readiness. Thus, a diversified investment strategy that covers various aspects of the 3D-printed meat value net could be a wise approach.

Despite a weakening demand for alternative proteins and recent layoffs at Beyond Meat, we believe we’ve barely started to see the impact of the alternate protein and cultivated meat sectors. While our recommendation focuses on 3D-printed meat companies, it is equally relevant for the entire cultured meat industry. This is a sector on the cusp of significant growth, driven by a combination of technological innovation, environmental consciousness, and shifting consumer preferences.

As described on their websites: Upside Foods uses “a proprietary platform to grow muscle and fat cells together on a scaffold, creating a realistic texture and flavor for its chicken bites and duck products.” Meatable uses decellularized plant tissues, creating a meat-like texture and structure. Future Meat Technologies grows muscle and fat cells separately and then combines them in different ratios to create various types of cultured meat products such as chicken, lamb and beef.

Chicken nuggets were invented at Cornell University in the 1950s. They are made of small pieces of chicken meat (it’s called a “slurry” - a term used to describe the cells grown in bioreactors) that are battered or breaded, then deep fried or baked. While they are usually made of chicken breast, they may also contain other parts of the chicken, skin, fat, connective tissue and bone. Chicken nuggets often contain starch, preservatives, and other flavorings. In fact, a 2013 study published in the American Journal of Medicine found that less than half of the material in chicken nuggets from two fast food chains was skeletal muscle, while the rest was fat, epithelial tissue, bone, nervous tissue and connective tissue. The authors concluded that “chicken nuggets are mostly fat, and their name is a misnomer.” If you want to dig deeper and see how McDonald’s makes their chicken nuggets, here’s a video.

For a deeper dive into consumer acceptance of alternate proteins and GMOs, see our blog post Cultured Meat is Good to Go.

If you’d like to know more about cultivated meat and our work here at Messaginglab, subscribe to our newsletter below.